The Benoit Group Finances Atlanta Project

The Benoit Group, in partnership with Atlanta Housing, received financing for the development of Englewood Senior in Atlanta. This affordable seniors housing project marks the first redevelopment phase of a master-planned, mixed-use, multi-plase community on the 30-acre site of the former Englewood Manor public housing site. Built in 1971, Englewood Manor offered 324 public housing units before the residents were relocated in 2007, followed by the property’s demolition in 2009 with HUD approval. The site is located in southeast Atlanta approximately 1.5 miles from Grant Park. Funding for this $72 million project includes federal and state equity tax credit investment by Raymond James and... Read More »

National Lending Group Divests in Wisconsin

Justin Knapp, Nick Stahler and Ray Giannini of Marcus & Millichap recently closed the receivership sale of an 86-bed skilled nursing facility in Wisconsin. The Knapp-Stahler Group represented the seller, a national lending group that also provided financing for the deal. The borrower/buyer was a local operator with ties to an East Coast-based equity partner. Built in 1928, the facility has 58,000 square feet across three stories on a 38-acre lot. No financial or operational details were disclosed. Read More »

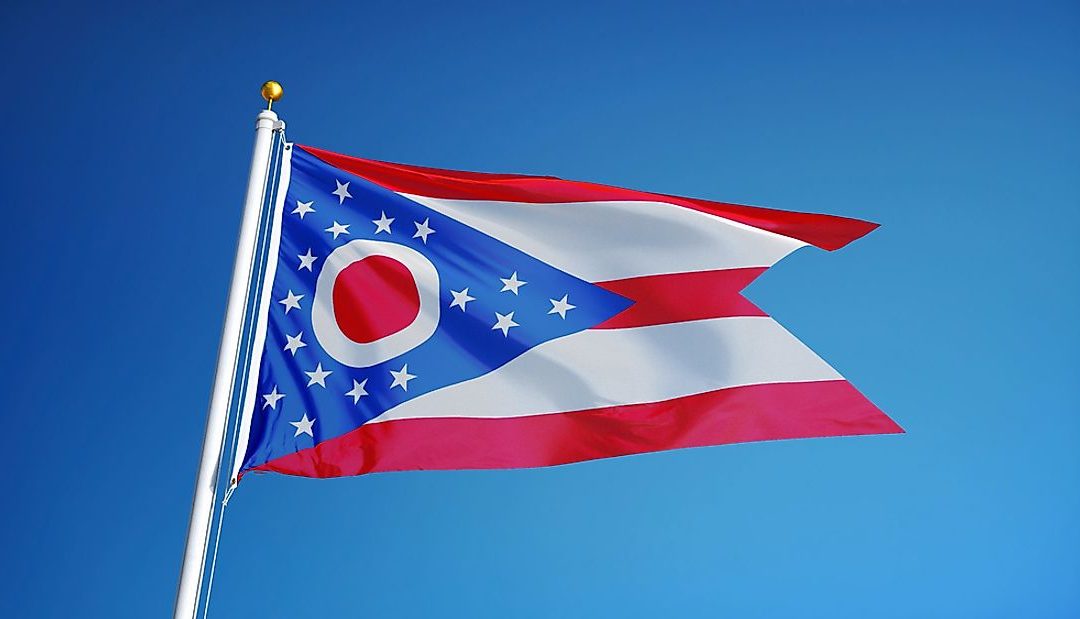

CFG Secures Bridge-to-HUD Loan for Ohio Skilled Nursing Facility

Capital Funding Group secured financing for a skilled nursing facility in Ohio on behalf of a nationally recognized borrower. The bridge-to-HUD loan totals $13.5 million and supports the refinancing of this 120-bed SNF. Tim Eberhardt and Ava Julio of CFG originated the transaction. This financing follows CFG’s closing of two HUD loans on behalf of a nationally recognized borrower. The loans supported the refinancing of two SNFs in Florida that comprise 261 beds. The loan totaled $17.4 million. Read More »

CBRE Secures Financing For Class-A Seniors Housing Community

CBRE secured financing for a Class-A seniors housing community in North Dakota on behalf of a joint venture borrower. Built in 2017, New Perspective West Fargo is in Fargo, one mile from Sanford Medical Center, North Dakota’s newest and largest medical center. The community features 128 independent living, assisted living and memory care units and is managed by New Perspective Senior Living. The joint venture borrower includes New Perspective, Boldt Real Estate Development and Fengate Asset Management. New Perspective develops, invests and operates senior living communities, with a portfolio of 40 communities in Minnesota, Wisconsin, Illinois, Indiana and North Dakota. Boldt is a... Read More »

PCP Purchases Ohio Assisted Living Community

Phorcys Capital Partners LLC, the investment advisor to Phorcys Senior Housing Recovery Fund LP (SHRF), announced it acquired a seniors housing community in Wickliffe, Ohio, through a trustee-directed short sale for $13.0 million, or $81,000 per unit. This is PCP’s second investment in SHRF, and it will continue to focus on the winding down of muni-finance bond transactions to add additional assets to its senior living portfolio. Built in 1979 as a hotel and renovated/converted in 2018, Tapestry Senior Living Wickliffe is a four-story assisted living community comprised of 160 studio and one-bedroom units, with 124,212 square feet on 5.2 acres. It was previously operated by Tapestry Senior... Read More »

Newmark Closes Class-A Deal in Denver

A new seniors housing community traded in the Denver, Colorado MSA, with the help of the team at Newmark. Developed in 2017, MorningStar at RidgeGate is located in the suburb of Lone Tree within the Ridgegate master plan that features retail, cultural amenities and a 284-bed hospital nearby. The property comprises five stories over subterranean parking and has 224 total units: 124 independent living, 71 assisted living and 29 memory care. It was historically well occupied, averaging above 93% since 2020. And there was attractive in-place debt on the property, which certainly helps to entice investors (and boost the purchase price). Considering the property vintage, quality and... Read More »

Public REIT Purchases Texas Class-A Seniors Housing

Blueprint was engaged in the divestment of a Class-A seniors housing community in San Antonio, Texas. Built in two phases in 2011 and 2017, Franklin Park TPC Parkway comprises 269 independent living, assisted living and memory care units. Following the completion of a six-year freeway expansion project that affected leasing, access to the community dramatically improved. Brooks Blackmon, Ben Firestone and Lauren Nagle handled the transaction. There was a competitive marketing process with five written letters of intent from REITs, owner/operators and real estate investment firms, resulting in multiple rounds of bidding. The ultimate buyer was a public REIT that elected to maintain Franklin... Read More »

Eads Sells Its 24th & 25th Missouri Community

Patrick Byrne of Eads Investment Brokerage facilitated the divestment of two seniors housing communities in Missouri. This marks the 24th and 25th communities sold in Missouri for Eads. The Moberly community (which we believe to be Mark Twain Assisted Living) comprises 35 assisted living/independent living units and sold for $2.57 million, or $73,000 per unit. It regularly produced EBITDA around $300,000. The seller was a local owner/operator that built and expanded the community over the course of 30 years. A local owner/operator establishing its footprint in a new market bought the community. Next, PREA brought on Eads to sell its affordable seniors housing community in Concordia that... Read More »

60 Seconds with Swett: CMS Raises the Minimum Staffing Mandate

On Monday, CMS came out with its final minimum staffing standards for nursing homes, but the eventual outcome is anything but final. Despite the outcry from nursing home providers from the previous proposed mandate of three hours per resident per day, asking simple questions like how can we pay for this and where will this newly needed staff come from, CMS has now raised the minimum to 3.48 hours per resident day, which includes .55 hours for an RN and 2.45 hours that can be fulfilled by a nurse aid, now including LPNs, which were excluded from the prior version of the rule. It will also require facilities to have a registered nurse onsite 24/7. The rule will be implemented gradually over... Read More »